WHAT IS BUSINESS & PERSONAL CREDIT?

Personal Credit is your individual financial reputation, measured by factors like your payment history, debt-to-income ratio, and credit utilization. It’s critical for securing personal loans, credit cards, and even housing or job opportunities.

Business Credit represents your company’s ability to borrow and manage debt responsibly. It’s tied to your business’s financial health and is essential for obtaining loans, securing vendor relationships, and growing your enterprise. Building strong credit in both areas gives you the financial freedom and credibility to achieve your goals. That’s where Lair Notary & Tax Pros comes in!

HOW CAN WE HELP YOUR BUSINESS & PERSONAL CREDIT?

Credit Report Analysis: We review your credit reports line by line to identify errors, inaccuracies, or negative items holding you back.

Dispute Resolution: Our team will handle disputes with credit bureaus to remove incorrect or outdated information that’s affecting your score.

Establish Business Tradelines: We help you build a strong credit history for your business by setting up and managing key tradelines.

Education & Guidance: Gain insights into maintaining healthy credit habits, ensuring your scores continue to grow over time.

Credit Utilization Strategies: Learn how to manage credit cards and loans effectively to improve your credit profile.

TAKE ADVANTAGE OF OUR CREDIT REPAIR PROGRAMS TODAY!

Credit Utilization Strategies: Learn how to manage credit cards and loans effectively to improve your credit profile.

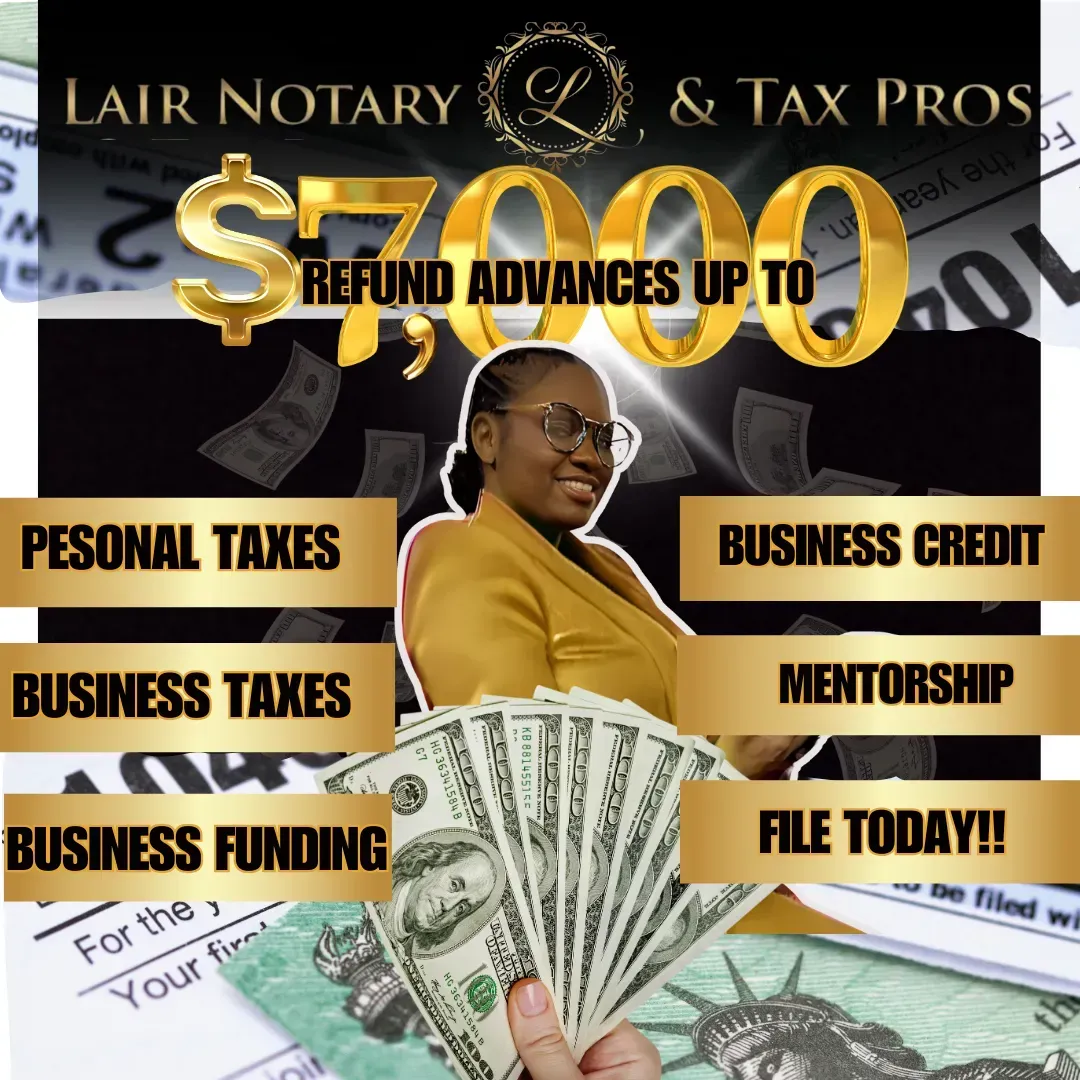

SERVICES OFFERED

ARE YOU A TAX AGENT? REALLY LOOKING TO GROW YOUR BUSINESS?

TAKE ADVANTAGE OF OUR SOFTWARE DEALS & AMAZING BUNDLES

TO HELP YOU GROW YOUR TAX BUSINESS TODAY!!

TAKE ADVANTAGE OF OUR CREDIT

REPAIR PROGRAMS TODAY!

Boost Your Credit and Unlock Business Funding with Lair Notary and Tax!

Ready to take your credit to the next level?

At Lair Notary and Tax, our Done-For-You Credit Repair Service is designed to do the heavy lifting for you while you focus on growing your business. We’ll walk you through every step of the process while delivering fast, tangible results!! Our clients see improvements in as little as 7 days!

Credit Monitoring – Stay on top of your credit with real-time updates and insights.

Personalized Dispute Process – We handle all the back-and-forth with credit bureaus to correct inaccuracies.

Access to Hundreds of Lenders – Get in front of the right lenders to secure the funding your business needs.

Customized Business Funding Strategy – Tailored solutions to help you achieve your financial goals.

Don’t wait for opportunities to come to you—create them! With our proven strategies and dedicated support, you'll be on the path to better credit and stronger financial opportunities in no time!!

DON'T MISS OUT ON THESE AMAZING OFFERS

WHEN YOU FILE WITH LAIR NOTARY & TAX PROS!!

SEE WHAT OTHERS ARE SAYING ABOUT US!!

Why Choose Lair Notary & Tax Pros?

Tailored Funding Solutions

We connect you with lenders who specialize in funding businesses like yours, ensuring the best fit for your needs.

Loan Application Support

From SBA loans to working capital, we guide you through the application process to maximize your approval chances.

Pitch Deck & Financials Preparation

Need to impress investors or lenders? We help you craft compelling presentations and organize financial documents.

Let us pave the way to a brighter financial future!

Our team is dedicated to your success.

We bring expertise, personalized service, and proven strategies to help you achieve your financial goals.

Grant Opportunities

Discover grants your business may qualify for and let us assist you in applying.

Vendor Credit Setup

Establish vendor accounts to improve your business credit profile and access essential supplies without upfront costs.

JOIN OUR FREE WEBINAR LIST!! STAY UPDATED ON ALL THINGS TAX RELATED,

AMAZING FREEBIES, EBOOKS, TEMPLATES, AND SO MUCH MORE!!!

OFFICE DEPOT NET 30 ACCOUNT

What is credit repair?

Credit repair is the process of identifying and disputing inaccurate, incomplete, or outdated information on your credit report. The goal is to improve your credit score by ensuring that your credit report accurately reflects your financial history.

How long does credit repair take?

The length of time varies depending on the complexity of your credit issue. On average, it can take 3-6 months to see significant improvements, but some clients may notice changes in as little as 30 days.

Can all negative items be removed from my credit report?

No. Only inaccurate, unfair, or unverifiable items can be removed. If an item on your credit report is accurate and verifiable, it cannot be removed, but we can help you manage its impact on our overall credit score.

Will the items that are removed from my credit report come back?

Once an item is removed, it should not reappear unless it is later verified as accurate. If an item does reappear, we will reinitiate the dispute process on your behalf.

Do you offer a money-back guarantee?

Yes, If we are unable to remove any inaccurate, unverifiable, or outdated information from your credit report within a certain time frame, we offer a money-back guarantee. Please contact us for more details on our refund policy.

How long after someone make a payment that you start working on their credit?

Once payment is made, & client completes onboarding process, we start working immediately.

Is there a payment after 30 minutes consultation?

Yes, there will be a $75 (non-refundable) fee for a 30 minutes meeting.